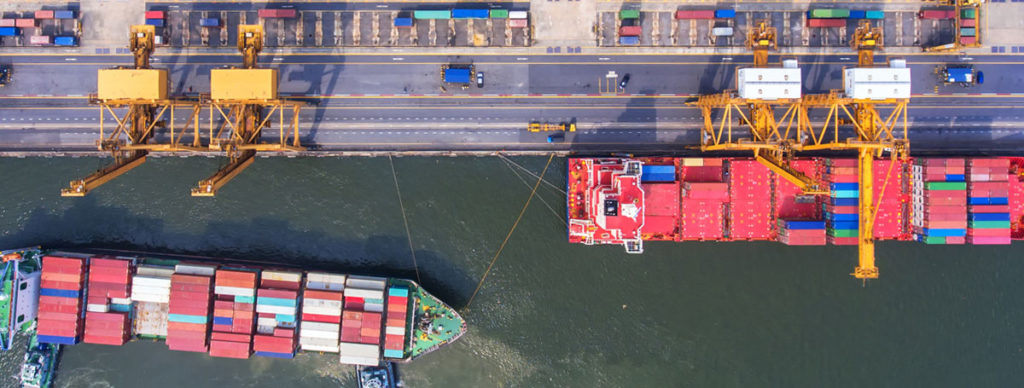

U.S. railroads start off 998,168 carloads in December 2017, up 2.5 percent from December 2016. U.S. railroads and also initiate 1,065,965 containers and trailers in December 2017, up 5.3 percent from the same month last year. Joint U.S. carload and intermodal originations in December 2017 were 2,064,133, up to 4 percent from December 2016. In December 2017, 14 of the 20 carload goods class tracked by the AAR saw carload increase compared with December 2016. These incorporated: compressed stone, sand & gravel, up to 15,632 carloads or 23.1 percent; metallic ores, up to 6,875 carloads or 35.2 percent; and chemicals, up to 4,277 carloads or 3.5 percent. Freight that saw decrease in December 2017 from December 2016 consists of: grain, down to 5,542 carloads or 6.1 percent; motor vehicles & parts, down to 2,625 carloads or 4.1 percent; and nonmetallic minerals, down to 1,424 carloads or 8.9 percent.

Railroads initiated 1,065,777 carloads in October, down to 0.1% from October, 2016. But a documentation of 1,144,157 containers and trailers was up 6.4% on-year. Joint carload and intermodal originations were 2,209,934, up 3.1% year-on-year. The overall U.S. carload traffic for the first 10 months of 2017 was 11,172,437 carloads, up 3.4%, and 11,576,709 intermodal units, up 3.7%. Total joint traffic for the first 43 weeks of 2017 was 22,749,146 carloads and intermodal units, a boost of 3.6%.

US railroads’ carload traffic increased 3.4% to ~268,000 railcars in Week 49 of 2017; when match up to ~259,000 units in the same week last year. Intermodal traffic’s rising force sustained with volumes increasing 4.6% to ~293,000 units from ~280,000 units in Week 49 of last year.

Intermodal traffic has been picking up steam this year and is now increasing at a rate of 5-6 percent, which is back to the twofold of the GDP or above the standard development rate which it was good to see after several slow years and drop in oil prices,” observed Bill R, a management consultancy. “The present development proposes that truck capacity is lessening a bit and truck rates are increasing.

While carload demand remains strong, numerous indicators show that we may have approved the growth climax. The inventory-to-sales proportion in the US is tracking sideways, signifying the time when companies look to refill inventories quickly which often gives the rail carload a boost. The upward trend in seasonally-adjusted freight capacity has been moderated. Freight volumes are still projected to grow in 2018, even though at a slower rate than in 2017.