Virtually all railways create economic and societal benefits, but these are hardly acknowledged in fiscal standards. It is up to governments to outline public as disparate to commercial or private benefits. If it is considered logical to have a viable railway, then the government needs to work out a way to pay for its remunerations.

With great levels of fixed infrastructure cost, railways are by nature costly to build, control, and maintain. Each route needs to produce adequate revenue to cover its costs. In contrast to road and air, a railway has the ability to handle large volumes, using less energy per unit of transport. It is safer and normally has less environmental influence. Rail can carry passengers at higher speeds than road, and its freight shipping capacity can support the growth of industries that may not be applied with other modes. The presence of a rail service, specifically in urban environments, can expressively boost property values.

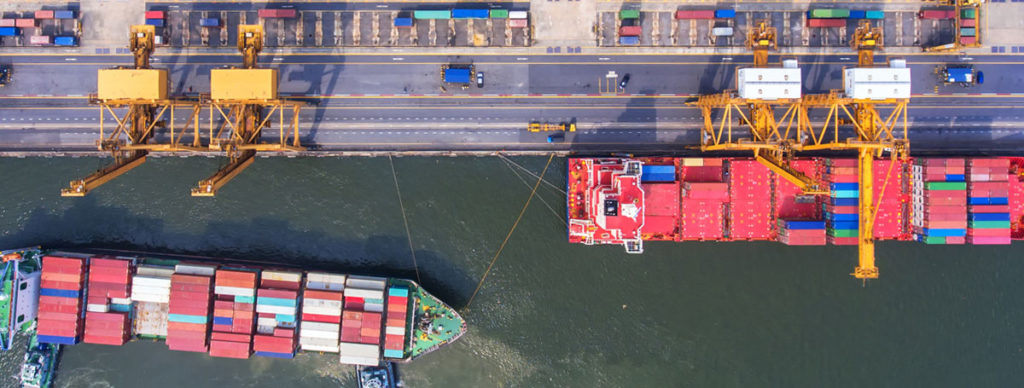

Rail freight supports production rate more than $80 billion yearly to the U.S economy. Agriculture, forestry and fishing, manufacturing and mining justify for majority of the freight from regional centers. U.S most momentous road freight corridors are the ones connecting the coast capital. In 2017, the U.S rail network transported 157 million tons of freight (33 per cent of the total State freight task). Coal made up most of U.S rail freight task. The rail freight network in U.S plays a serious role in assisting the national freight task, with 75 per cent of interstate truck freight in America using the road network for some part of its journey.

Ignoring auxiliary activities, a railway earns the majority of its revenue from passenger tickets and freight charges. It does not profit straight from reduced road congestion, or from the knock-on welfares of boosting rail-served industries. More latest data proposes that the prominence of American freight railroads on coal shipments has only become more pronounced, accounting for 47% of tons moved on the railways in 2017. So making the U.S. dependence on an incredibly polluting, inefficient power source upped the use of trains for freight.

Local road infrastructure can compel freight network connections, striking higher costs on business and communities. A viable rail freight network – one with the ability to transmit a larger share of the total freight task – is precarious to the productivity and keenness of businesses, as well as the broader U.S economy.